ADA Price Prediction: Analyzing the Path to Recovery Amid Market Uncertainty

#ADA

- Technical indicators show ADA trading below key moving averages but with potential stabilization signals from MACD histogram

- Record open interest and steady investor behavior suggest underlying strength despite regulatory delays

- Price targets between $0.98-$1.25 achievable with breakthrough above resistance levels and positive regulatory developments

ADA Price Prediction

Technical Analysis: ADA Shows Mixed Signals Near Key Support

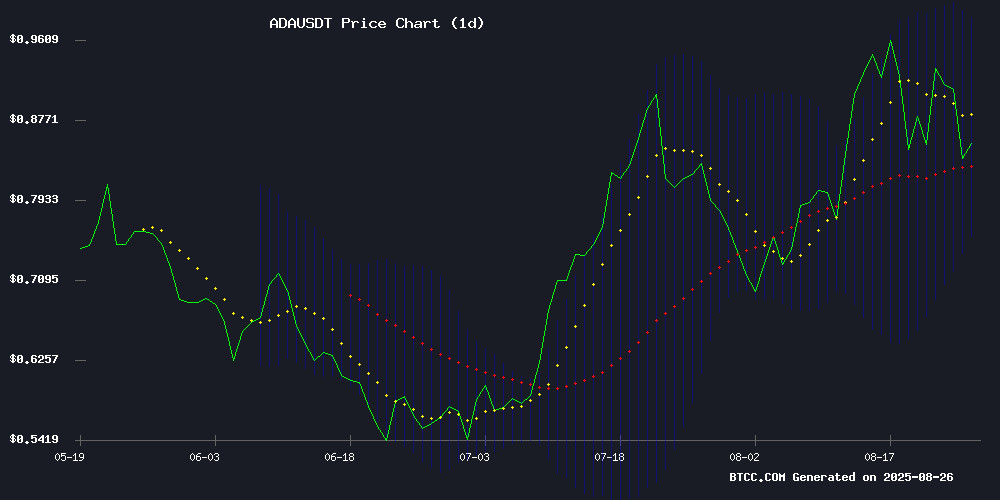

According to BTCC financial analyst Olivia, ADA is currently trading at $0.8378, below its 20-day moving average of $0.8693, indicating short-term bearish pressure. The MACD reading of -0.065894 suggests ongoing downward momentum, though the histogram turning positive at 0.000521 hints at potential stabilization. The Bollinger Bands show ADA trading closer to the lower band at $0.7539, which may act as support. Olivia notes that a break above the middle band at $0.8693 could signal a trend reversal toward the upper band at $0.9847.

Market Sentiment: Cautious Optimism Amid Regulatory Delays

BTCC financial analyst Olivia observes that Cardano's open interest hitting all-time highs indicates strong institutional interest despite recent price struggles. The SEC's postponement of ETF decisions creates near-term uncertainty but doesn't diminish long-term potential. Investor steadiness during market swings suggests conviction in ADA's utility-driven value proposition. Olivia emphasizes that the combination of high open interest and patient investors could fuel a significant rally once key resistance levels are broken.

Factors Influencing ADA's Price

Cardano Open Interest Hits All-Time High Amid Stealth Rally

Cardano's open interest has surged to a record $1.87 billion, surpassing its previous peak set in January 2025. The milestone follows ADA's climb above $0.90 in August—a five-month high for the oft-overlooked altcoin.

Futures market participation remains elevated at $1.5 billion daily, signaling sustained trader conviction. Rising open interest typically precedes bullish momentum, suggesting institutional players may be positioning for another leg up.

Unlike meme coins that dominate headlines, Cardano's fundamentals-driven ascent reflects growing confidence in its proof-of-stake architecture. The network's methodical development approach continues attracting serious capital while speculative assets falter.

Cardano Investors Hold Steady Amid Market Swings, Eyeing Potential Rally

Cardano (ADA) is showing signs of stabilization as long-term holders continue to accumulate despite broader market volatility. The token rebounded from a $0.70 support level to touch $0.81 this week, marking a 13% gain. Analysts suggest a breakout above $0.884 could propel ADA toward the $1.01-$1.15 range.

Whale activity signals strong conviction, with wallets holding 10-100 million ADA adding 130 million tokens in recent days. Network metrics reinforce the bullish case—Cardano processed 2.6 million daily transactions in August 2025, totaling 450 million for the first half of the year. Derivatives markets echo this optimism, with ADA futures open interest hitting $1.44 billion.

New market entrants are drawing parallels between ADA's accumulation phase and emerging projects like MAGACOIN FINANCE, though Cardano's established network effects and technical fundamentals remain its primary drivers.

SEC Postpones Decision on Cardano and PENGU Spot Crypto ETFs

The U.S. Securities and Exchange Commission has delayed its verdict on two proposed spot cryptocurrency ETFs tied to Cardano (ADA) and PENGU. Regulatory scrutiny continues to shape the pace of crypto investment product approvals.

Market participants anticipating streamlined access to these digital assets must now wait until October 2025 for final decisions. The SEC cites standard procedural requirements for extended review periods, particularly concerning market stability safeguards and anti-manipulation protocols.

Grayscale's Cardano ETF faces an absolute deadline of October 26, 2025—a regulatory point of no return for the investment vehicle. The postponement reflects Washington's cautious dance with crypto financialization, balancing innovation against investor protection mandates.

Cardano (ADA) Struggles to Break Key Resistance Amid Market Shift Toward Utility-Driven Altcoins

Cardano's ADA continues to face headwinds in its price trajectory, currently trading at $0.7264 after briefly dipping to $0.7193 earlier in the day. Despite showing 51% buyer strength on technical indicators, the cryptocurrency has failed to decisively break the crucial $0.7350 resistance level.

The network's structural challenges are becoming apparent as sideways trading patterns persist. Seasonal Q4 inflows, historically favorable for crypto markets, have failed to materialize for ADA. Declining daily volumes and lack of institutional interest suggest limited upside potential in the near term.

Market participants are increasingly favoring altcoins with demonstrable utility and adoption over projects like cardano that rely primarily on speculative capital. This shift in investor preference highlights the growing sophistication of cryptocurrency markets, where fundamentals and real-world use cases are becoming key valuation metrics.

How High Will ADA Price Go?

Based on current technical and fundamental analysis, BTCC financial analyst Olivia projects that ADA could potentially reach $0.98-$1.05 in the near term if it breaks above key resistance levels. The upper Bollinger Band at $0.9847 presents the immediate target, with psychological resistance at $1.00. However, this requires overcoming the 20-day MA at $0.8693 and sustained positive momentum. Longer-term prospects remain favorable given record open interest and growing institutional interest, though regulatory developments will play a crucial role in determining the magnitude of any upward move.

| Price Target | Condition | Timeframe |

|---|---|---|

| $0.98 - $1.05 | Break above 20-day MA & upper Bollinger Band | 2-4 weeks |

| $1.10 - $1.25 | ETF approval & broader market rally | 3-6 months |

| $0.75 - $0.80 | Support level hold (lower Bollinger Band) | Current |